The forex market, a swirling ocean of currencies in constant flux, presents both tantalizing opportunities and treacherous currents for traders. Riding the waves of trends can propel portfolios to profitability, but mistaking a ripple for a tsunami can lead to devastating losses. So, how can traders navigate this dynamic landscape and identify the trends that hold the key to success?

Finding the Trend

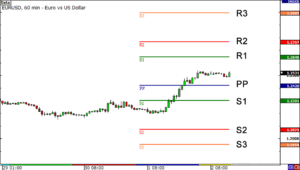

- Technical Analysis: Charting price movements is a fundamental skill for trend identification. Look for consistent patterns like higher highs and higher lows (uptrend) or lower highs and lower lows (downtrend). Trendlines drawn through these key points visualize the direction and momentum.

- Indicators: Technical indicators like Moving Averages and Relative Strength Index (RSI) can add depth to your analysis. Moving Averages smooth out price data, making trends clearer, while RSI identifies overbought and oversold conditions, potentially signaling trend reversals.

- Volume Confirmation: High volume accompanying a trend strengthens its validity. Conversely, low volume during a supposed trend may indicate weakness.

Beyond the Chart

- Fundamental Analysis: Don’t neglect the underlying economic forces driving currency movements. Central bank policies, economic data releases, and geopolitical events can influence currency relationships and trigger trend formations.

- Sentiment Analysis: Gauging market sentiment through news, reports, and analyst opinions can provide valuable insights into prevailing trends and potential shifts.

Capitalizing on the Trend

- Position Sizing: Enter trades with appropriate position sizes that align with your risk tolerance and account size. Remember, even strong trends can experience temporary setbacks.

- Stop-Loss Orders: Limit your downside risk by placing stop-loss orders below critical support levels in downtrends and above resistance levels in uptrends. This helps mitigate losses if the trend breaks unexpectedly.

- Profit Taking: Don’t get greedy! Taking profits at key profit targets or resistance levels protects gains and allows you to re-enter the market if the trend resumes.

Advanced Techniques

- Breakout Trading: Identify trend continuations by waiting for price to break through key resistance levels in uptrends or support levels in downtrends.

- Pullback Trading: Capitalize on temporary retracements within a trend by entering during pullbacks to key moving averages or Fibonacci retracement levels.

- Trendline Trading: Use trendlines as dynamic support and resistance levels to find high-probability entry and exit points.

Remember

- Trends are never permanent: Always be prepared for trend reversals. Use confirmation signals and monitor fundamental factors for potential shifts.

- Risk management is paramount: Protect your capital with proper position sizing, stop-loss orders, and sound risk management practices.

- No strategy is foolproof: Back-test your strategies on historical data and constantly adapt them to market conditions.

Identifying and capitalizing on trends in the forex market requires a blend of technical and fundamental analysis, discipline, and risk management. By developing your analytical skills, staying informed about market forces, and implementing sound trading strategies, you can navigate the turbulent waters of the forex market and unlock the potential for substantial returns. However, remember, success in forex trading is a journey, not a destination. Embrace continuous learning, adapt your approach to evolving market conditions, and never lose sight of the inherent risks involved. With dedication and perseverance, you can carve your own path to success in the ever-dynamic world of currency trading.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.