In the fast-paced world of forex trading, where currencies are traded around the clock, economic events play a crucial role in influencing market movements. Among these events, the release of non-farm payroll (NFP) data stands out as one of the most significant. This article explores how major economic events, particularly the NFP report, impact forex markets, and why traders closely monitor these releases.

Understanding Non-Farm Payrolls (NFP)

Before delving into the impact of NFP on forex markets, it’s essential to understand what non-farm payrolls entail. The NFP report is a key economic indicator released monthly by the U.S. Bureau of Labor Statistics. It provides valuable insights into the overall health of the U.S. labor market by detailing the total number of paid workers, excluding farm employees, government employees, private household employees, and employees of nonprofit organizations. As one of the most closely watched economic indicators, the NFP report has a significant impact on various financial markets, including forex.

Impact on Currency Markets

- Volatility Surge: The release of NFP data typically triggers a surge in market volatility. As traders eagerly await the report, there is often heightened anticipation and uncertainty regarding the outcome. When the actual figures are released, especially if they deviate significantly from market expectations, it can lead to sharp movements in currency prices. Sudden spikes or drops in volatility can catch traders off guard, resulting in rapid price fluctuations.

- U.S. Dollar Strength: Given that the NFP report provides insights into the health of the U.S. labor market, its impact on the U.S. dollar is particularly pronounced. A better-than-expected NFP figure, indicating robust job growth and a healthy economy, tends to strengthen the U.S. dollar. Investors interpret strong employment data as a sign of economic growth and potential interest rate hikes by the Federal Reserve to curb inflation. Consequently, the U.S. dollar appreciates against other currencies in the forex market.

- Interest Rate Expectations: The NFP report not only influences current currency valuations but also shapes expectations regarding future monetary policy decisions. Positive NFP data can lead to speculation that the Federal Reserve may adopt a more hawkish stance, signaling a potential tightening of monetary policy. In anticipation of higher interest rates, investors may flock to the U.S. dollar, driving up its value in the forex market. Conversely, weaker-than-expected NFP figures could prompt expectations of dovish monetary policy, exerting downward pressure on the U.S. dollar.

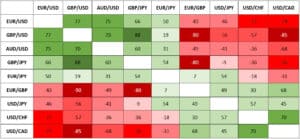

- Impact on Cross-Currency Pairs: While the NFP report directly impacts the U.S. dollar, its effects ripple across other currency pairs as well. Cross-currency pairs involving the U.S. dollar, such as EUR/USD, GBP/USD, and USD/JPY, are particularly sensitive to NFP releases. Traders assess the implications of NFP data not only for the U.S. economy but also for its counterparts. For example, strong NFP figures may lead to a sell-off in the euro against the U.S. dollar as investors shift their funds to the relatively stronger greenback.

- Safe-Haven Flows: In times of economic uncertainty or market turbulence, investors often seek refuge in safe-haven currencies such as the U.S. dollar, Japanese yen, or Swiss franc. The release of NFP data can exacerbate or mitigate risk sentiment in the forex market, depending on the report’s implications for broader economic conditions. Positive NFP figures may boost risk appetite, prompting investors to move away from safe-haven currencies and towards higher-yielding assets. Conversely, disappointing NFP data could trigger a flight to safety, bolstering demand for safe-haven currencies.

- Market Sentiment and Expectations: Apart from the actual NFP figures, market sentiment and expectations also play a crucial role in shaping forex market reactions. Analysts and economists often release forecasts and projections leading up to the NFP release, based on various indicators and economic data. These expectations become ingrained in market sentiment and can influence trader behavior. Consequently, even if the actual NFP figures are strong, but fall short of overly optimistic forecasts, it could still lead to a muted response or even a sell-off in the U.S. dollar.

Risk Management Strategies

Given the inherent volatility surrounding NFP releases and their potential to move currency markets, effective risk management is paramount for forex traders. Here are some strategies to consider:

- Setting Stop-Loss Orders: Placing stop-loss orders can help limit potential losses in case of adverse market movements following the release of NFP data. By defining exit points in advance, traders can mitigate the risk of significant losses during periods of heightened volatility.

- Adjusting Position Sizes: Given the increased uncertainty surrounding NFP releases, traders may opt to reduce their position sizes to manage risk effectively. Smaller position sizes can help cushion against large price swings and minimize exposure to unexpected market movements.

- Utilizing Hedging Instruments: Employing hedging instruments such as options or futures contracts can provide downside protection during volatile market conditions. Traders can hedge their forex positions against adverse NFP outcomes while still maintaining exposure to potential upside movements.

- Avoiding High-Leverage Trading: While leverage can amplify profits in favorable market conditions, it also magnifies losses during periods of volatility. Traders should exercise caution when employing leverage around NFP releases to avoid excessive risk-taking and potential margin calls.

In conclusion, major economic events such as non-farm payrolls (NFP) have a significant impact on forex markets, influencing currency valuations, market sentiment, and investor behavior. The release of NFP data triggers heightened volatility, with the U.S. dollar often experiencing pronounced movements in response to the report’s findings. Positive NFP figures can strengthen the U.S. dollar, while weaker-than-expected data may lead to dollar depreciation. Traders must carefully assess the implications of NFP releases and implement effective risk management strategies to navigate the volatile forex market successfully. By understanding the dynamics of NFP-related movements and employing prudent risk management techniques, traders can position themselves to capitalize on opportunities while mitigating potential losses.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.