Traders often use fundamental analysis to make informed forex decisions. Fundamental analysis involves examining economic indicators, geopolitical events, and other factors that could affect currency prices. By understanding these factors, traders can make better-informed decisions about when to buy or sell currencies. In this article, we will explore how traders can use fundamental analysis to make informed forex decisions.

Economic Indicators

Economic indicators are statistics that provide information about the state of an economy. These indicators can include things like inflation rates, unemployment rates, and GDP growth. By examining these indicators, traders can get a sense of how healthy an economy is and how likely it is to affect currency prices.

For example, if a country has a high inflation rate, its currency is likely to depreciate in value. This is because inflation erodes the purchasing power of a currency, making it less attractive to investors. Conversely, if a country has a low inflation rate, its currency is likely to appreciate in value.

Unemployment rates can also affect currency prices. If a country has a high unemployment rate, its currency is likely to depreciate in value. This is because high unemployment can lead to lower consumer spending, which can hurt the economy. Conversely, if a country has a low unemployment rate, its currency is likely to appreciate in value.

GDP growth is another important economic indicator. GDP measures the total value of all goods and services produced in a country. If a country’s GDP is growing, its currency is likely to appreciate in value. This is because a growing economy is seen as a sign of strength, which can attract investors.

Geopolitical Events

Geopolitical events can also affect currency prices. These events can include things like wars, political unrest, and natural disasters. By examining these events, traders can get a sense of how they might affect currency prices.

For example, if a country is at war, its currency is likely to depreciate in value. This is because wars can disrupt trade and hurt the economy. Conversely, if a country is at peace, its currency is likely to appreciate in value.

Political unrest can also affect currency prices. For example, if a country is experiencing political instability, its currency is likely to depreciate in value. This is because political instability can create uncertainty, which can make investors nervous.

Natural disasters can also affect currency prices. For example, if a country experiences a natural disaster, its currency is likely to depreciate in value. This is because natural disasters can disrupt trade and hurt the economy.

By examining economic indicators and geopolitical events, traders can get a sense of how they might affect currency prices. This can help them make better-informed decisions about when to buy or sell currencies.

Technical Analysis

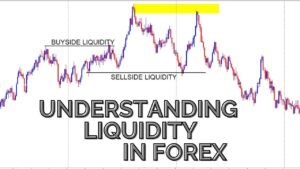

In addition to fundamental analysis, traders can also use technical analysis to make informed forex decisions. Technical analysis involves using charts and other tools to analyze past price movements and identify trends. By identifying trends, traders can get a sense of where a currency might be headed in the future.

For example, if a currency has been trending upwards for several weeks, it is likely to continue trending upwards in the future. Conversely, if a currency has been trending downwards for several weeks, it is likely to continue trending downwards in the future.

By combining fundamental analysis with technical analysis, traders can make more informed decisions about when to buy or sell currencies. This can help them maximize their profits and minimize their losses.

In conclusion, traders can use fundamental analysis to make informed forex decisions. By examining economic indicators, geopolitical events, and other factors, traders can get a sense of how they might affect currency prices. This can help them make better-informed decisions about when to buy or sell currencies. By combining fundamental analysis with technical analysis, traders can maximize their profits and minimize their losses.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.