The world of finance encompasses various markets where individuals and institutions can trade different assets. While some may appear similar at first glance, each market has unique characteristics that influence how transactions occur and the risks involved. This article delves into how the foreign exchange (forex) market differs from two other prominent financial markets: stocks and commodities.

Market Structure and Organization

One of the most striking differences between these markets lies in their structure and organization.

- Forex: The forex market is decentralized, meaning it lacks a central physical location and operates electronically through a network of financial institutions around the world. This 24-hour, 5-day-a-week market thrives on the continuous exchange of currencies between various parties, facilitating international trade and investment.

- Stocks: Stock markets, in contrast, are centralized entities with designated exchanges, such as the New York Stock Exchange (NYSE) or the London Stock Exchange (LSE). These exchanges operate during specific hours, typically weekdays, and facilitate the buying and selling of individual company shares.

- Commodities: Similar to forex, the commodities market is decentralized, with transactions occurring electronically on platforms or through over-the-counter (OTC) agreements. However, unlike currencies, commodities represent physical goods like oil, gold, or agricultural products, traded through designated contracts and delivery schedules.

Underlying Assets and Ownership

The underlying assets traded in each market are another point of distinction:

- Forex: As mentioned earlier, the forex market deals in currencies. When you trade a currency pair, such as EUR/USD, you essentially speculate on the exchange rate between these two currencies. You don’t own the underlying assets themselves, but rather, you profit or lose based on the fluctuation in the exchange rate.

- Stocks: In the stock market, you buy and sell ownership stakes in companies through shares. Owning a share represents a partial ownership of the company, and potential returns come from dividends, capital appreciation (increase in share price), or both.

- Commodities: When trading commodities, you don’t necessarily take physical ownership of the underlying good. Instead, you often trade contracts that represent ownership of the commodity for a specific future date. Owning the physical commodity might be an option in certain circumstances, depending on the specific contract type.

Trading Mechanics and Leverage

The mechanisms of trading and the use of leverage also differ significantly between these markets:

- Forex: Forex trading often involves leverage, which allows traders to control a larger position than their initial capital. This can amplify both profits and losses, making it a high-risk, high-reward market. Forex trades are typically settled immediately (spot transactions) or within a short period, with rolling over positions incurring additional costs.

- Stocks: Buying and selling stocks usually involve using your own capital, with limited leverage options compared to the forex market. This generally reduces the potential risk and reward compared to forex. Stock settlements typically occur within a few business days after the trade execution.

- Commodities: Leverage is also available in commodity trading, but to a lesser extent than in forex. Commodity contracts have specific expiration dates, and depending on the contract type, physical delivery of the underlying good might be required upon contract expiry.

Market Liquidity and Volatility

The level of liquidity and volatility in each market also varies:

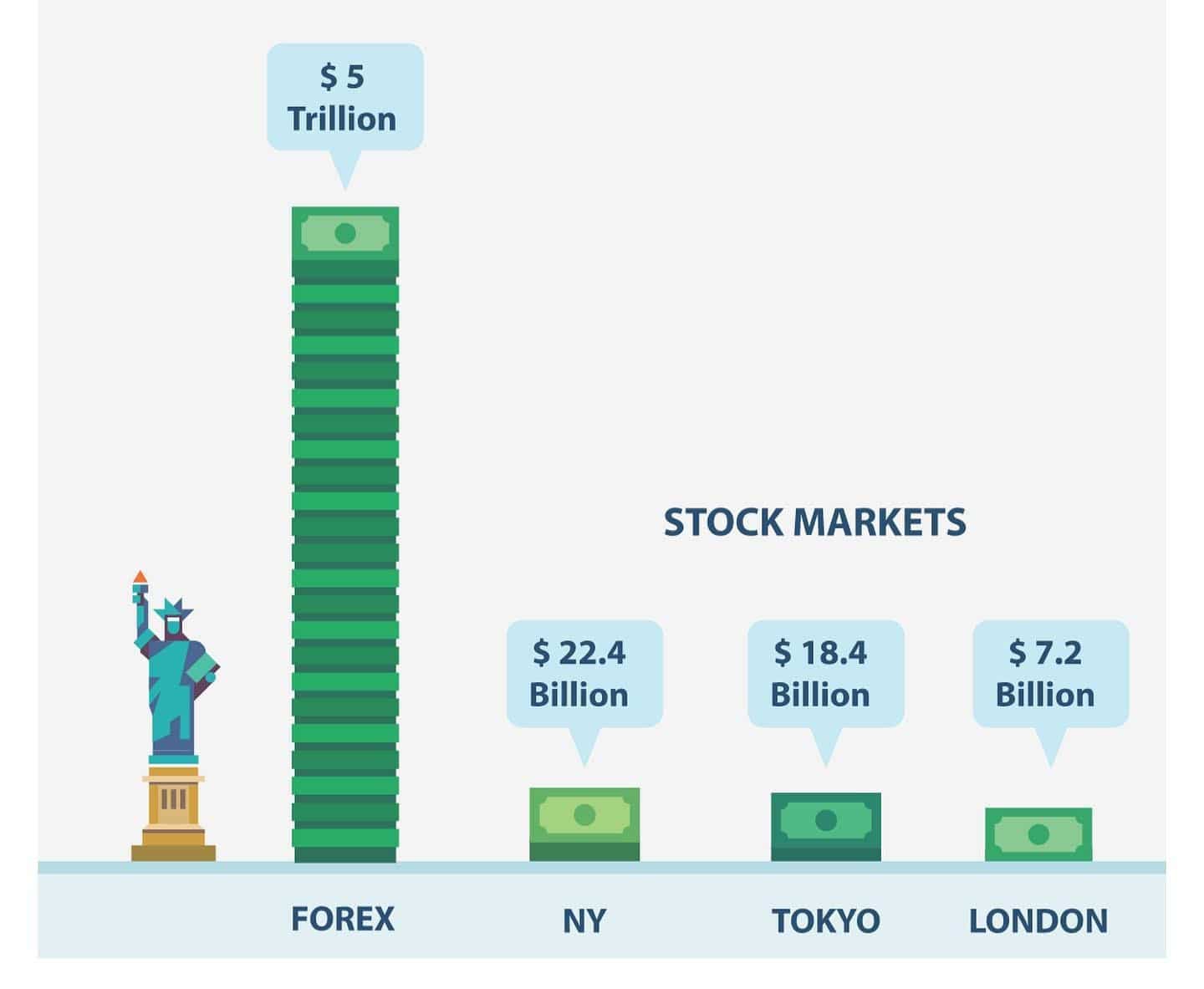

- Forex: Due to its immense size and global participation, the forex market boasts the highest liquidity, meaning assets can be easily bought and sold with minimal price impact. However, currency prices are often subject to high volatility due to various economic and political factors impacting global exchange rates.

- Stocks: The liquidity of the stock market varies depending on the specific company and exchange. Generally, large-cap stocks in major exchanges are more liquid than smaller companies traded on regional exchanges. Stock prices can be volatile, but the degree of volatility depends on the company’s sector, financial health, and other market conditions.

- Commodities: Commodity markets exhibit varying levels of liquidity depending on the specific commodity. Generally, commonly traded commodities like oil tend to be more liquid than less common ones. Commodity prices are also susceptible to volatility due to factors like supply chain disruptions, weather changes, and geopolitical events.

Understanding the fundamental differences between the forex, stock, and commodity markets is crucial for individuals considering participating in any of these markets. Each market offers unique opportunities and risks, and choosing the right one depends on your individual financial goals, risk tolerance, and investment horizon. Consulting with a qualified financial advisor can help you navigate these complexities and make informed investment decisions.

It’s important to remember that this is just a brief overview of the key differences between these markets. Each market has its own complexities and nuances, and conducting thorough research and due diligence is essential before entering any financial market.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.