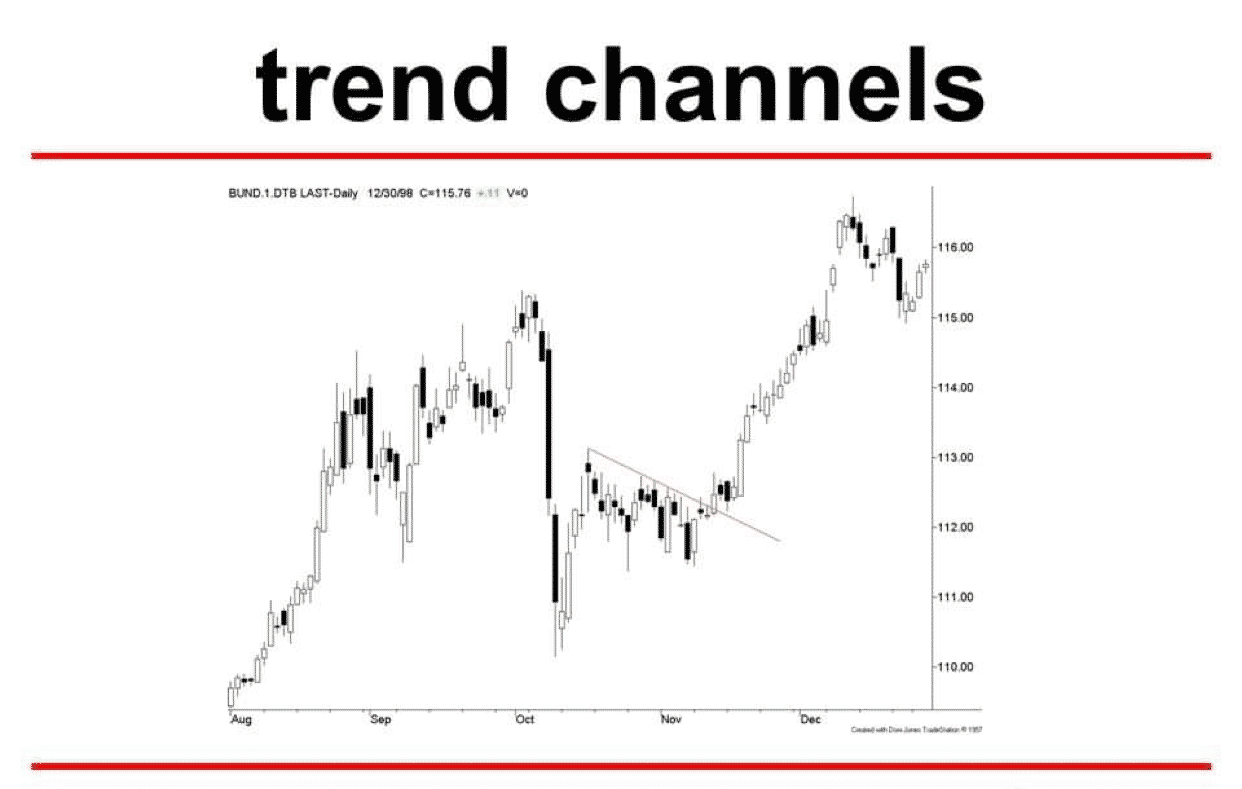

We can create Trend channels by taking this trend line theory a step further and drawing a parallel line at the same angle as the uptrend or downturn.

No, we aren’t referring to ESPN, National Geographic, or Cartoon Network.

These aren’t television channels; instead, they’re trend channels, sometimes known as price channels.

However, this does not imply that you should leave as if it were a commercial break. Channels may be just as entertaining as Tiger King or Keeping Up with the Kardashians!

Trend channels are yet another technical analysis tool that may be utilized to find potential buy and sell opportunities.

Resistance is marked by the upper trend line, while support is marked by the lower trend line. As a result, both the tops and bottoms of channels might serve as possible support or resistance points.

Bearish trend channels have a negative slope (down), whereas bullish trend channels have a positive slope (up).

Simply draw a parallel line at the same angle as an uptrend line and move it to a location where it contacts the most recent peak to establish an up (ascending) channel. This should be done at the same time that the trend line is being created.

Simply draw a parallel line at the same angle as the downtrend line and move it to a location where it touches the most recent valley to establish a down the (descending) channel. This should be done at the same time that the trend line is being created.

When prices reach the LOWER trend line, this could be a good time to buy.

The UPPER trend line may be utilized as a selling area when prices reach it.

Types of Trend Channels

There are three types of channels:

- Ascending channel (higher highs and higher lows)

- Descending channel (lower highs and lower lows)

- Horizontal channel (ranging)

Some traders prefer to use the terms “rising channel” for an ascending channel and “falling channel” for a descending channel. Most likely, Millennials.

Important Things to Remember About Drawing Trend Channels

Both trend lines must be parallel to each other when creating a trend channel.

The bottom of the trend channel is generally seen as a “buy zone,” while the top of the trend channel is seen as a “sell zone.”

DO NOT FORCE THE PRICE TO THE CHANNELS THAT YOU DRAW, JUST AS YOU DO NOT FORCE THE PRICE TO THE TREND LINES THAT YOU DRAW!

A channel boundary that slopes at one angle while the matching channel boundary slopes at another angle is incorrect and may result in bad trades.

When this happens, the chart pattern becomes a triangle rather than a trend channel. (About which you’ll learn more later).

Trend channels, on the other hand, do not have to be perfectly parallel. It’s also not necessary for every price movement to fall within the channel. Many traders make the mistake of merely looking for textbook price patterns.

They miss crucial price action information and restrict their eyes to other crucial indicators.

Take a look at the channel diagrams below…

Do they appear to be in fantastic condition?

Waiting for textbook examples that are picture-perfect won’t help you in the real world since price behavior that fits neatly within two perfectly parallel trend lines is rare.

It’s similar to looking for the ideal man or lady in the real world. Don’t let go of that individual once you’ve found them.

Looking for a highly rated forex fund manager?

Fx Pips Guru has a strong group of forex experts who are managing forex accounts of our clients from different brokers dedicatedly. Just hire our forex fund managers here : https://www.fxpipsguru.com/forex-fund-manager/ .