Scalping is a popular trading strategy in the forex market that involves making numerous trades throughout the day to take advantage of small price movements. Successful scalping requires a broker that can offer tight spreads, fast execution speeds, and a reliable trading platform. In this guide, we will explore the best forex brokers for scalping, detailing their features, advantages, and what sets them apart from the competition.

What is Scalping in Forex?

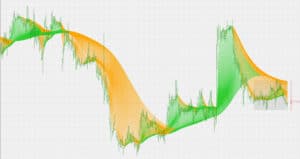

Scalping involves executing multiple trades in a single day, often holding positions for just a few seconds to minutes. Scalpers aim to profit from small price changes, typically focusing on liquid currency pairs. To be successful at scalping, traders need:

- Fast Execution: The ability to enter and exit trades quickly.

- Low Spreads: Since profits are made on small price movements, tight spreads are crucial.

- Stable Platforms: A reliable trading platform that minimizes downtime and latency.

- High Leverage: This allows scalpers to maximize potential profits from small market movements.

Characteristics of the Best Forex Brokers for Scalping

When evaluating forex brokers for scalping, traders should consider the following factors:

1. Low Spreads

A tight spread can significantly enhance a scalper’s profitability. Brokers that offer low spreads ensure that scalpers can enter and exit trades without incurring large costs.

2. Fast Execution Speed

Scalping requires the ability to execute trades within milliseconds. Brokers with low latency servers are preferred by scalpers.

3. Quality Trading Platform

A user-friendly and feature-rich trading platform helps scalpers manage multiple trades effectively. Look for platforms that support advanced order types and have integrated technical analysis tools.

4. Regulatory Compliance

Regulation is essential in forex trading. Well-regulated brokers provide a layer of security for traders’ funds and ensure fair trading practices.

5. Customer Support

Reliable customer support is crucial, especially during high-pressure trading sessions. Brokers should provide multiple channels for support, including live chat, phone, and email.

Top Forex Brokers for Scalping

1. BlackBull Markets

BlackBull Markets is a reputable forex broker that offers a wide range of tradable instruments, including forex pairs, indices, commodities, and cryptocurrencies. With a focus on providing a seamless and efficient trading experience, BlackBull Markets boasts tight spreads, fast execution speeds, and a user-friendly trading platform. Their commitment to client satisfaction is evident through their excellent customer support and educational resources.

2. Fusion Markets

Fusion Markets is a forex and CFD broker known for its low trading costs. They offer a wide range of tradable instruments including forex pairs, cryptocurrencies, indices, shares, and commodities. With a focus on accessibility, they have no minimum deposit requirement and provide platforms like MetaTrader 4 and 5 for trading. While their product selection is competitive, some users find the MetaTrader platform less user-friendly.

3. Pepperstone

Pepperstone is an established forex and CFD broker, known for its tight spreads and reliable trading platforms. They offer commission-free accounts with standard spreads or commission-based accounts with even tighter spreads.

Traders can choose from the popular MetaTrader 4, 5 and cTrader platforms, with the option to use them on desktop, web or mobile. Pepperstone is regulated in multiple jurisdictions for added security and is considered a highly trusted broker. They cater to various experience levels, from beginners to high-volume traders.

4. TMGM

TMGM is a reputable forex broker offering a wide range of tradable instruments, including forex pairs, indices, commodities, and cryptocurrencies. With a focus on providing a seamless and efficient trading experience, TMGM boasts tight spreads, fast execution speeds, and a user-friendly trading platform. Their commitment to client satisfaction is evident through their excellent customer support and educational resources.

5. Axi

Axi (formerly known as AxiTrader) is a globally recognized forex broker offering a range of trading services, primarily focusing on currency pairs but also covering other assets like commodities, indices, and cryptocurrencies. Established in 2007 and headquartered in Australia, Axi has grown into a reputable platform used by traders across the world, attracting both beginners and seasoned professionals.

6. GO Markets

GO Markets is a forex and CFD broker offering trading on over 1,000 instruments, including popular currency pairs, indices, commodities, and metals. They advertise tight spreads, leverage up to 500:1, and commission-free accounts.

GO Markets focuses on providing a user-friendly experience with platforms like MetaTrader 4 and 5, along with 24/7 multilingual customer support. They highlight segregated client funds and fast execution as trust-building measures. With a focus on regulation, competitive pricing, and platform accessibility, GO Markets positions itself as a potential solution for new and experienced traders looking to enter the CFD and forex markets.

7. FXTM

FXTM is a global online forex and CFD broker known for its diverse range of trading instruments, competitive pricing, and educational resources. They offer a variety of account types to suit different trading styles and experience levels, along with a user-friendly trading platform. With a strong focus on customer satisfaction, FXTM provides excellent support and educational materials to help traders of all levels succeed.

Tips for Successful Scalping

While choosing the right broker is crucial, success in scalping also depends on effective trading strategies. Here are some tips:

1. Develop a Clear Strategy

Establish a well-defined trading plan, including entry and exit points, risk management, and target profits.

2. Use Technical Analysis

Scalpers often rely on technical analysis, utilizing indicators like moving averages, RSI, and Fibonacci retracements to make quick decisions.

3. Manage Risk

Keep risk management in mind. Set stop-loss orders to minimize potential losses and protect your capital.

4. Stay Informed

Keep up with economic news and events that can cause volatility in the forex market, affecting your scalping trades.

5. Practice Discipline

Stay disciplined and stick to your trading plan. Emotional trading can lead to poor decisions and losses.

Choosing the best forex broker for scalping involves considering various factors such as spreads, execution speed, platform reliability, and customer support. Ultimately, successful scalping requires not only the right broker but also a well-thought-out trading strategy, discipline, and continuous learning. By leveraging the strengths of the right broker, scalpers can enhance their chances of making consistent profits in the fast-paced forex market.

Let’s Have Forex Trade Copying Service From Expert Traders!

Fx Pips Guru is a forex trade copying service provider company from expert traders. Let’s do Live Chat with our experts.