The foreign exchange market, also known as Forex, is a vast and dynamic landscape where currencies are constantly traded in pairs. Understanding how these pairs interact with each other is crucial for making informed trading decisions. This is where the concept of correlation between currency pairs comes into play.

Currency Correlation Explained

Currency correlation refers to the statistical relationship between the price movements of two different currency pairs. It essentially measures how likely one pair is to move in the same or opposite direction as another pair. This interconnectedness can be attributed to various factors, including:

- Economic Ties: Countries with strong economic ties often see their currencies move in tandem. For example, the Euro (EUR) and the British Pound (GBP) tend to be positively correlated due to the close economic relationship between the Eurozone and the United Kingdom.

- Interest Rates: Central bank interest rate decisions can significantly impact currency valuations. If two countries raise or lower interest rates in a similar fashion, their currencies might move in the same direction.

- Market Sentiment: Broader market sentiment towards specific regions or currencies can influence multiple pairs simultaneously. For instance, a risk-averse market environment might lead to a strengthening of the US Dollar (USD) against various currencies, including the Euro and the Japanese Yen (JPY).

Correlation Coefficients: Quantifying the Relationship

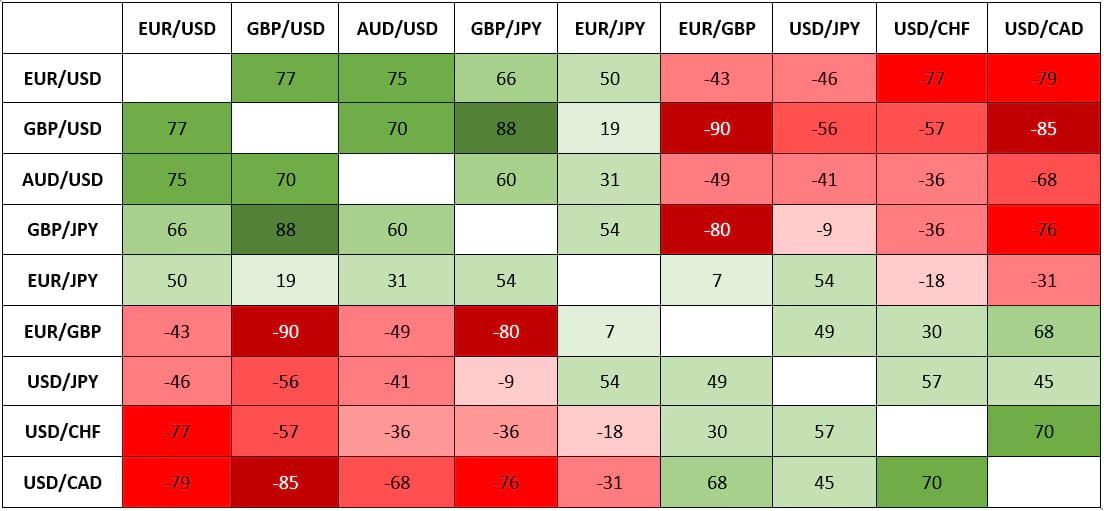

Forex traders utilize correlation coefficients to measure the strength and direction of the relationship between currency pairs. These coefficients range from -1 to +1:

- Positive Correlation (+1 to close to +1): Indicates that the two pairs tend to move in the same direction. For example, a coefficient of +0.8 between EUR/USD and AUD/USD suggests that when EUR/USD strengthens, AUD/USD is likely to appreciate as well (though not necessarily to the same extent).

- Negative Correlation (-1 to close to -1): Represents a situation where the pairs move in opposite directions. A coefficient of -0.7 between USD/CHF and EUR/CHF implies that a rising USD/CHF (meaning a stronger USD against CHF) might coincide with a weakening EUR/CHF (a stronger EUR against CHF).

- Low Correlation (close to 0): Suggests little to no linear relationship between the pairs. Their movements are largely independent of each other.

How Correlation Influences Trading Decisions

Understanding currency correlation empowers forex traders with valuable insights to inform their strategies. Here’s a breakdown of some key applications:

1. Diversification and Risk Management:

- Hedging: By identifying negatively correlated pairs, traders can implement hedging strategies. For example, a long position on EUR/USD (buying EUR with USD) can be partially hedged with a short position on USD/CHF (selling USD with CHF). If the USD strengthens unexpectedly, the losses in EUR/USD might be offset by gains in USD/CHF, mitigating overall risk.

- Portfolio Diversification: Including pairs with low or negative correlations in a trading portfolio can help spread risk. Instead of relying solely on positively correlated pairs that might move in the same direction due to a single event, diversification offers some protection against market swings.

2. Identifying Trading Opportunities:

- Confirmation of Trends: Positive correlations can strengthen existing trends. If a trader identifies a bullish trend in EUR/USD and observes a similar upward movement in a positively correlated pair like AUD/USD, it might solidify the trader’s confidence in the EUR/USD long position.

- Exploiting Divergences: Temporary deviations from the expected correlation pattern can present trading opportunities. If a historically positively correlated pair like EUR/USD and GBP/USD starts diverging, a trader might anticipate a correction and enter a trade expecting the lagging pair to catch up to the leading one.

3. Market Sentiment Analysis:

- Gauging Global Risk Aversion: When multiple positively correlated pairs involving the USD experience a simultaneous appreciation, it might signal a flight to safety and a strengthening USD due to global risk aversion. Traders can adjust their strategies accordingly, potentially favoring safe-haven currencies like the USD or JPY.

- Identifying Regional Economic Strength: If a currency pair tied to a specific region exhibits a strong positive correlation with another pair from the same region, it might indicate economic strength in that region. This information can be factored into fundamental analysis to support trading decisions.

Limitations of Correlation

While correlation is a valuable tool, it’s crucial to acknowledge its limitations:

- Dynamic Relationships: Correlations are not static. Economic events, policy changes, or unforeseen circumstances can alter the historical relationship between pairs.

- Imperfect Correlations: Even with strong positive or negative coefficients, the movements won’t be perfectly mirrored. The magnitude of change and timing can differ between pairs.

- Focus on Technical Analysis: Correlation primarily deals with historical price movements and doesn’t account for fundamental factors like economic data releases or geopolitical events that can significantly impact currency values.

Beyond Correlation: A Holistic Approach

Forex trading success hinges on a comprehensive approach that integrates correlation analysis with other key considerations:

- Technical Analysis: Technical indicators and chart patterns can provide additional confirmation for trades based on correlation insights. For instance, a positive correlation between EUR/USD and AUD/USD identified for a potential long trade on EUR/USD can be further validated by a bullish breakout pattern on the EUR/USD chart.

- Fundamental Analysis: Economic data releases, central bank policies, and geopolitical events can significantly impact currency valuations. A strong positive correlation between USD/JPY and AUD/USD might suggest a potential long trade on USD/JPY. However, if key economic data from Japan unexpectedly weakens the JPY, the trade could turn sour.

- Risk Management: Effective risk management practices like stop-loss orders and position sizing are crucial regardless of correlation analysis. These strategies help limit potential losses even if correlations don’t play out as expected.

Understanding currency correlation equips forex traders with a powerful tool to navigate the complexities of the market. By analyzing correlations, traders can make informed decisions about diversification, risk management, and identifying potential trading opportunities. However, it’s vital to remember that correlation is just one piece of the puzzle. Combining correlation analysis with technical and fundamental analysis, along with sound risk management practices, is the key to successful forex trading.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.