The foreign exchange market, also known as forex or FX, is a vast and dynamic arena where currencies are constantly traded against each other. For traders navigating this ever-shifting landscape, understanding economic cycles is a crucial weapon in their arsenal. Economic cycles, characterized by periods of expansion, peak, contraction, and trough, significantly influence currency valuations. By deciphering the economic health of a nation and its position within its cycle, traders can anticipate potential currency movements and make informed trading decisions.

Economic Indicators and Their Impact on Currencies

The forex market reacts to a multitude of economic factors, but a few key indicators hold immense weight:

- Gross Domestic Product (GDP): This metric reflects the total value of goods and services produced within a country’s borders. A rising GDP suggests a robust economy, potentially leading to a stronger currency. Conversely, a declining GDP indicates a weakening economy and could depreciate the currency.

- Interest Rates: Central banks manipulate interest rates to influence economic activity. Higher interest rates incentivize saving, attracting foreign investment, and ultimately strengthening the domestic currency. Conversely, lower interest rates stimulate borrowing and spending, potentially weakening the currency.

- Inflation: Inflation refers to the general rise in prices of goods and services over time. Moderate inflation is considered healthy, but runaway inflation erodes the purchasing power of a currency, making it less valuable.

- Trade Balance: This indicator measures the difference between a country’s exports and imports. A consistent trade surplus, where exports exceed imports, reflects strong demand for a country’s goods and services, potentially appreciating the currency. Conversely, a chronic trade deficit suggests a reliance on foreign goods and could depreciate the currency.

- Unemployment Rate: A low unemployment rate signifies a healthy economy where businesses are thriving and demand for labor is high. This could translate to a stronger currency. Conversely, a high unemployment rate indicates a sluggish economy, potentially weakening the currency.

Aligning Economic Cycles with Currency Movements

By analyzing these economic indicators, traders can align their forex strategies with the different stages of an economic cycle:

Expansion: During an economic expansion, GDP is rising, unemployment is low, and inflation is under control. Central banks may raise interest rates to curb inflation, attracting foreign investment and strengthening the domestic currency. Traders anticipating this phase might buy the currency of a country in expansion, aiming to profit from its potential appreciation.

Peak: As the expansion reaches its peak, economic growth starts to slow down. Interest rates may have reached their peak or may start to plateau. While the currency may still hold some strength, the upward momentum starts to fade. Traders may choose to hold or exit their positions during this stage, depending on their risk tolerance.

Contraction: When the economy enters a contractionary phase, often referred to as a recession, GDP falls, unemployment rises, and inflation might fluctuate. Central banks may lower interest rates to stimulate borrowing and spending, potentially weakening the currency. Traders anticipating this phase might short-sell the currency, essentially borrowing it and selling it in anticipation of repurchasing it later at a lower price.

Trough: At the bottom of the economic cycle, the economy starts showing signs of recovery. While still fragile, this stage presents a potential buying opportunity for the long term. As the economy rebounds, the currency may follow suit.

Beyond Economic Indicators: Additional Considerations

Economic cycles are a powerful tool, but they are not the only factor influencing forex markets. Here are some additional considerations for a comprehensive trading strategy:

- Geopolitical Events: Political instability, war, and trade disputes can significantly impact a nation’s economic outlook and currency valuation.

- Market Sentiment: The overall mood of the market, whether optimistic or pessimistic, can influence currency movements regardless of fundamental economic factors.

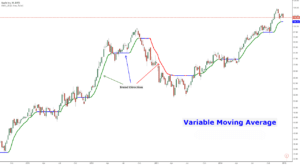

- Technical Analysis: Studying historical price charts and technical indicators can help traders identify potential entry and exit points for their trades.

Utilizing a Multifaceted Approach

The most successful forex traders combine economic cycle analysis with a variety of other factors. By staying informed about global economic trends, political developments, and market sentiment, traders can make informed decisions.

Here are some resources for staying updated:

- Economic Calendars: Numerous online resources provide economic calendars listing upcoming economic data releases for various countries.

- Financial News Websites and Publications: Reputable financial news sources offer in-depth analysis of economic trends, geopolitical events, and market sentiment.

- Central Bank Websites: Central banks publish statements, meeting minutes, and policy decisions that can influence currency valuations.

Remember: Forex trading is inherently risky. While understanding economic cycles can provide valuable insights, it is not a foolproof method for predicting currency movements. Always practice sound risk management techniques, such as setting stop-loss orders to limit potential losses.

By mastering economic cycle analysis and incorporating a multifaceted approach, forex traders can significantly improve their chances of success in the ever-evolving forex market.

Benefits of Utilizing Economic Cycles

Understanding economic cycles offers several benefits for forex traders:

- Improved Trade Timing: By aligning trading strategies with different stages of the economic cycle, traders can potentially enter positions when a currency is undervalued and exit before its value depreciates.

- Reduced Risk: By anticipating potential currency movements based on economic trends, traders can implement risk management strategies more effectively.

- Informed Decision Making: Economic analysis provides valuable context for interpreting market movements and making informed trading decisions.

- Long-Term Perspective: Analyzing economic cycles encourages a long-term outlook, helping traders avoid getting caught up in short-term market noise.

Challenges and Limitations

Despite its advantages, economic cycle analysis has limitations:

- Uncertainty and Volatility: Economic data can be prone to revisions, and unexpected events can disrupt even well-defined economic cycles. Markets are inherently volatile, and unforeseen circumstances can cause sudden changes in currency valuations.

- Time Lag: Economic data releases often have a lag effect, meaning the information might reflect past economic activity. Traders need to be mindful of this delay when making trading decisions.

- Complexity: Global economies are interconnected, and analyzing individual economic cycles in a vacuum can be misleading. Understanding the broader global economic landscape is crucial.

Economic cycles offer a powerful framework for analyzing currency movements in the forex market. By combining economic analysis with other factors like technical analysis, geopolitical events, and market sentiment, traders can develop a comprehensive trading strategy. However, it’s crucial to acknowledge the limitations of this approach and practice sound risk management techniques. With dedication, perseverance, and a well-rounded understanding of economic cycles, forex traders can navigate the complexities of the market and make informed trading decisions that improve their chances of success.

Let’s Have Forex Trade Copying Service From Expert Traders!

Fx Pips Guru is a forex trade copying service provider company from expert forex traders. Let’s do Live Chat with our experts.