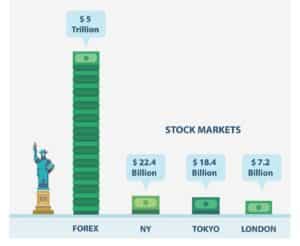

Forex trading, also known as foreign exchange trading or currency trading, involves the buying and selling of currencies in the global marketplace. It is one of the largest and most liquid financial markets, attracting a diverse range of participants, from individual traders to large financial institutions. While the potential for profits in forex trading is enticing, it is essential to understand the risks involved and adopt strategies to manage them effectively. In this article, we will explore the various risks associated with forex trading and delve into practical approaches for risk management.

Market Risk

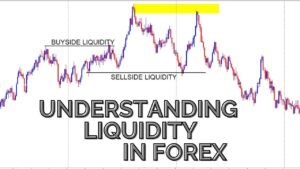

Market risk, also known as price risk, is the most fundamental risk in forex trading. It refers to the potential for losses due to unfavorable changes in exchange rates. Currency prices are influenced by a myriad of factors, including economic indicators, geopolitical events, and market sentiment. Traders need to be aware of the inherent volatility in the forex market, as sudden and unpredictable price movements can lead to significant financial losses.

Managing Market Risk:

a. Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses by automatically closing a trade when a predetermined price level is reached.

b. Diversification: Spread your investments across different currency pairs to reduce exposure to the risk of a single currency’s fluctuations.

c. Stay Informed: Keep abreast of economic news, geopolitical developments, and market trends to make informed trading decisions.

Leverage Risk

Leverage is a double-edged sword in forex trading. While it allows traders to control larger positions with a relatively small amount of capital, it also magnifies the impact of price movements, leading to increased risk. High leverage can result in rapid gains, but it can equally lead to substantial losses if the market moves against the trader.

Managing Leverage Risk:

a. Use Moderate Leverage: Avoid excessive leverage and opt for moderate levels that align with your risk tolerance and trading strategy.

b. Set Risk Limits: Determine the maximum percentage of your trading capital that you are willing to risk on a single trade, and stick to it.

c. Regularly Assess Risk Exposure: Monitor your leverage and adjust your position sizes as necessary to maintain a prudent risk profile.

Interest Rate Risk

Interest rate differentials between two currencies can impact the profitability of a forex trade. Central banks regularly adjust interest rates to manage their economies, and these changes can affect currency values. Traders need to be mindful of interest rate differentials and the potential impact on their positions.

Managing Interest Rate Risk:

a. Stay Informed on Economic Policies: Keep abreast of central bank announcements and economic indicators that signal potential changes in interest rates.

b. Hedge Against Interest Rate Movements: Consider using financial instruments such as options to hedge against adverse interest rate movements.

Counterparty Risk

Forex trading is conducted over-the-counter (OTC), meaning that transactions are decentralized and conducted directly between participants. Counterparty risk arises when one party fails to fulfill its financial obligations, such as settling a trade. While major financial institutions and brokers are generally reliable, there is always some level of counterparty risk in forex trading.

Managing Counterparty Risk:

a. Choose Reputable Brokers: Select brokers with a solid reputation and a history of financial stability.

b. Diversify Brokerage Relationships: Spread your trading capital across multiple brokers to reduce reliance on a single entity.

c. Regularly Monitor Broker Performance: Stay informed about your broker’s financial health and promptly address any concerns.

Psychological and Emotional Risks

The human element plays a crucial role in forex trading. Emotional factors such as fear, greed, and impatience can lead to irrational decision-making and contribute to trading losses. Managing psychological risks is often overlooked but is essential for long-term success in the forex market.

Managing Psychological and Emotional Risks:

a. Develop a Trading Plan: Create a well-defined trading plan that includes entry and exit strategies, risk management rules, and clear objectives.

b. Practice Discipline: Stick to your trading plan and avoid making impulsive decisions based on emotions.

c. Regularly Evaluate and Reflect: Assess your trading performance regularly, learn from mistakes, and continuously improve your approach.

Forex trading offers immense opportunities for profit, but it comes with inherent risks that must be managed effectively. Traders need to be aware of market dynamics, implement risk management strategies, and stay disciplined in their approach. By understanding and mitigating the various risks associated with forex trading, participants can enhance their chances of long-term success in this dynamic and complex financial market. Remember, knowledge, discipline, and a proactive risk management approach are key elements for navigating the challenges of forex trading.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.