Probably just as important as knowing where to enter or take off profits is knowing where to place your stop loss. Placing stops with fibs can save you to lose money.

You can’t just enter a trade based on Fib levels and without knowing where to quit it.

When you decide to employ your trusty Fib levels, you’ll discover a couple of strategies to establish your stops in this session.

These are some basic methods for determining your stop, as well as the reasoning behind each one.

Method #1: Place Stop Just Past Next Fib (Placing stops with Fibs)

Set your stop immediately past the next Fibonacci level in the first strategy.

You would position your stop beyond the 50.0 percent level if you were aiming to enter at the 38.2 percent Fib level.

If you thought the 50.0 percent level would hold, you’d move your stop beyond the 61.8 percent level, and so on. Isn’t it simple?

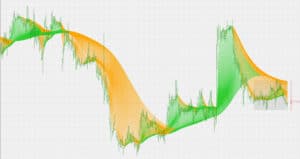

Let’s take another look at that 4-hour EUR/USD chart we showed you back in the Fibonacci retracement lesson.

You could have put your stop-loss order just past the 61.8 percent Fib level if you had shorted it at the 50.0 percent Fib level.

Because you thought the 50.0 percent level would hold as a resistance level, you used this way of setting stops. As a result, if the price rises over this level, your trade idea will be invalidated.

The issue with this method of stopping is that it is completely reliant on you having a perfect entry.

Setting a stop just past the next Fibonacci retracement level assumes that the support or resistance area will hold. Using sketching tools isn’t an exact science, as we mentioned earlier.

When the market rises, reach your stop, and then move in your direction. We’d usually move to a corner and start pounding our heads against the wall at this point.

We’re simply advising you that this could happen multiple times in a row, so make sure you limit your losses and let your winnings ride the wave.

This type of stop placement approach may be best suitable for short-term, intraday trades.

Method #2: Place Stop Past Recent Swing High/Low (Placing stops with Fibs)

Another option to position your stops if you want to be a little safer is to place them past the most recent Swing High or Swing Low.

When the price is in an uptrend and you’re long, for example, you can set a stop-loss slightly below the most recent Swing Low, which serves as a potential support level.

You can place a stop-loss immediately above the Swing High, which works as a potential resistance level when the market is in a downtrend and you’re shorting.

This form of stop loss placement would provide your trade more breathing room and increase your chances of the market moving in your favor.

If the market price exceeds the Swing High or Swing Low, it could suggest that a trend reversal is already underway.

This signifies that your trade concept or setup has already been disproven, and you’re too late to enter the market.

Setting greater stop losses is typically preferable for longer-term, swing-type trades, and you can include this into a “scaling in” strategy, which you will learn about later in this course.

Of course, with a greater stop, you must also remember to adapt the size of your position.

You could lose a lot of money if you always trade the same size position, especially if you begin at one of the earlier Fib levels.

Because you may have a wide stop that isn’t proportional to your possible gain, this can lead to some unfavorable reward-to-risk ratios.

So which way is better? (Placing stops with Fibs)

The truth is, just as you would use your knowledge of these tools to analyze the current environment to help you pick a good stop-loss point when using the Fibonacci retracement tool with support and resistance, trend lines, and candlesticks to find a better entry, you should use your knowledge of these tools to analyze the current environment to help you pick a good stop-loss point when using the Fibonacci retracement tool with support and resistance, trend lines, and candlesticks to find a better entry

You should avoid using Fibonacci levels as support and resistance points for stop loss placement as much as feasible. Keep in mind that setting a stop loss isn’t always a guaranteed thing.

However, if you can improve your odds by combining different tools, you may be able to get a better exit point, more breathing room for your trade, and possibly a better reward-to-risk ratio trade.

Looking for a highly rated forex fund manager?

Fx Pips Guru has a strong group of forex experts who are managing forex accounts of our clients from different brokers dedicatedly. Just hire our forex fund managers here: https://www.fxpipsguru.com/forex-fund-manager/.