The foreign exchange market, or forex for short, is the largest financial market globally, with trillions of dollars changing hands daily. While the potential for profit attracts many, the inherent volatility and high leverage can lead to significant losses if not managed effectively. This is where risk management comes into play, serving as the cornerstone of any successful forex trading strategy.

Understanding Risk in Forex Trading

Forex trading involves buying and selling currencies based on speculation about their future price movements. This inherent uncertainty carries various risks, including:

- Market risk: This refers to the possibility of losing money due to unforeseen changes in the market, such as economic data releases, political events, or central bank interventions.

- Liquidity risk: This risk arises from the difficulty of entering or exiting a trade quickly and at a desired price, especially in less frequently traded currency pairs.

- Leverage risk: Forex brokers often offer leverage, allowing traders to control a larger position with a smaller deposit. While this can amplify potential gains, it also magnifies losses.

- Execution risk: This is the risk of delays or slippage when entering or exiting a trade, potentially leading to unexpected losses.

- Emotional risk: Trading can be emotionally charged, and fear or greed can lead to impulsive decisions that deviate from a well-defined strategy, potentially resulting in losses.

The Crucial Role of Risk Management

Effective risk management is not about eliminating risk entirely, which is impossible in the dynamic world of forex. Instead, it focuses on mitigating the potential negative impact of these risks and protecting your trading capital.

Here’s how a sound risk management approach contributes to a successful forex trading strategy:

1. Preserves Capital: By implementing risk management techniques, you limit the amount of money you can lose on any given trade. This ensures your capital base remains intact, allowing you to continue trading over the long term and take advantage of future opportunities.

2. Promotes Discipline and Consistency: Establishing clear rules and risk parameters helps you maintain discipline and consistency in your trading approach. This prevents emotional trading decisions and ensures you stick to your strategy even during market downturns.

3. Builds Confidence and Enhances Control: Implementing a robust risk management framework fosters a sense of confidence and control over your trading activities. You know your potential losses are limited, allowing you to focus on executing your strategy with a clear head.

4. Encourages Long-Term Sustainability: By prioritizing risk mitigation, you shift the focus from short-term gains to long-term sustainability. This approach recognizes that even successful traders experience losses; the key is to manage them effectively to achieve consistent profitability over time.

Key Risk Management Strategies for Forex Trading

Several key strategies can be used to effectively manage risk in forex trading:

1. Position Sizing: This involves determining the appropriate amount of capital to allocate to each trade. A common approach is to risk a small percentage (e.g., 1-2%) of your total account per trade, ensuring a single losing trade doesn’t wipe out your entire capital.

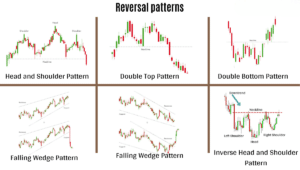

2. Stop-Loss Orders: These are automated orders that automatically exit a trade once the price reaches a predefined level, limiting potential losses. Setting appropriate stop-loss levels based on technical analysis and risk tolerance is crucial.

3. Take-Profit Orders: Similar to stop-loss orders, these orders automatically exit a trade once the price reaches a targeted profit level, securing gains and preventing potential reversals.

4. Risk-Reward Ratio: This ratio compares the potential profit to the potential loss for a trade. Aiming for a higher risk-reward ratio (e.g., 2:1 or 3:1) ensures that even with a lower win rate, successful trades will outweigh losses.

5. Diversification: Spreading your capital across different currency pairs, trading strategies, and asset classes can help to mitigate risk by reducing exposure to any single market movement.

6. Money Management: Maintaining proper capital allocation and practicing good money management are crucial. Never invest more than you can afford to lose, and always prioritize preserving your capital over chasing unrealistic returns.

7. Emotional Control: Recognizing and managing your emotions is vital in forex trading. Develop a trading plan, stick to it, and avoid letting fear or greed influence your decisions.

8. Continuous Learning and Education: The forex market is dynamic and constantly evolving. Remaining informed about economic events, technical analysis, and risk management strategies is essential for making informed trading decisions and adapting your approach as needed.

By incorporating these risk management strategies into your forex trading strategy, you can increase your chances of success in the long run. However, it’s important to remember that no single strategy guarantees profits in the volatile world of forex. Consistent discipline, continuous learning, and a commitment to risk management are critical for navigating the challenges and maximizing your profit.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.