Technical analysis in the trading world is all about deciphering the often-murky waters of price movements. Traditional candlestick charts, while valuable, can get cluttered with short-term fluctuations, making it difficult to discern the underlying trend. This is where the Heikin Ashi technique steps in, offering a simplified visual representation of price action. But for traders seeking an even smoother ride, the Smoothed Heikin Ashi emerges as a powerful tool.

Demystifying Heikin Ashi: A Refresher

Heikin Ashi, meaning “average bar” in Japanese, is a candlestick charting method with a twist. Unlike traditional candlesticks that depict the open, high, low, and close prices for a specific timeframe, Heikin Ashi modifies these values to provide a clearer picture of the trend. Here’s how it works:

- Open: The average of the previous close and current open price.

- High: The highest price of the current period or the previous high, whichever is higher.

- Low: The lowest price of the current period or the previous low, whichever is lower.

- Close: The current closing price.

This manipulation results in candlesticks with shorter wicks, emphasizing the direction and strength of the trend. Green candles indicate an uptrend (open < close), while red candles signify a downtrend (open > close).

Unveiling the Smoothed Heikin Ashi: A Step Further

The Smoothed Heikin Ashi takes the traditional Heikin Ashi concept and injects an additional layer of filtering. It accomplishes this by plotting Heikin Ashi candles as a moving average overlay on the price chart. There are two main approaches to achieve this smoothing effect:

- Moving Average of Heikin Ashi Prices: This method calculates a moving average (often an Exponential Moving Average or EMA) for the open, high, low, and close prices used to generate the Heikin Ashi candles. The resulting smoothed Heikin Ashi candles provide a more subdued view of the trend, further eliminating short-term noise.

- Moving Average of Traditional Prices: Alternatively, the smoothing can be applied directly to the underlying price data before generating the Heikin Ashi candles. This approach essentially smooths out the price action itself, which then translates into smoother Heikin Ashi candles on the chart.

The choice between these methods depends on individual preferences and trading strategies.

Benefits of the Smoothed Heikin Ashi

Traders are drawn to the Smoothed Heikin Ashi for several reasons:

- Enhanced Trend Clarity: By filtering out market noise, the smoothed candles provide a clearer picture of the prevailing trend. This allows traders to identify potential entry and exit points with greater confidence.

- Reduced False Signals: Traditional Heikin Ashi, while helpful, can still generate some false signals due to short-term price fluctuations. The smoothing effect significantly reduces these misleading signals, leading to more focused trading decisions.

- Improved Confirmation: The Smoothed Heikin Ashi can be used alongside other technical indicators to confirm potential trading signals. For instance, a crossover of smoothed Heikin Ashi candles above a smoothed moving average can provide a stronger confirmation of an uptrend.

Applications of the Smoothed Heikin Ashi

The Smoothed Heikin Ashi is a versatile tool that can be integrated into various trading strategies. Here are some common applications:

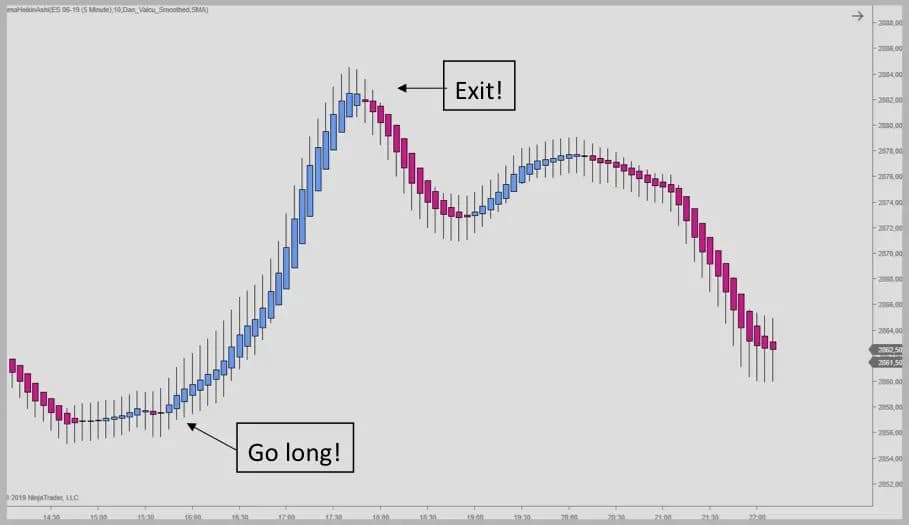

- Identifying Trend Direction: The color and body size of the smoothed Heikin Ashi candles clearly depict the trend direction. A series of green candles with large bodies indicates a strong uptrend, while red candles with large bodies signal a downtrend.

- Spotting Trend Reversals: A change in color of the smoothed Heikin Ashi candles, particularly after a sustained trend, can be an early warning sign of a potential trend reversal.

- Confirmation for Entries and Exits: The Smoothed Heikin Ashi can be used alongside other indicators to confirm entry and exit signals. For example, a crossover of the smoothed Heikin Ashi with a moving average or a divergence with a momentum indicator can strengthen the case for a trade.

Limitations to Consider

Before diving headfirst into trading with the Smoothed Heikin Ashi, it’s crucial to acknowledge its limitations:

- Lag: The smoothing process inherently introduces lag into the indicator. This means the smoothed Heikin Ashi candles may react slower to price changes compared to traditional candlesticks.

- Hidden Price Action: By filtering out noise, the smoothed Heikin Ashi can potentially obscure important price details, such as support and resistance levels. It’s recommended to use the smoothed Heikin Ashi in conjunction with other tools that provide a more comprehensive view of price action.

- Not a Standalone Tool: The Smoothed Heikin Ashi, like any technical indicator, should not be used in isolation. Always incorporate it into a broader trading strategy that considers fundamental analysis and risk management techniques.

Optimizing Your Smoothed Heikin Ashi Experience

To get the most out of the Smoothed Heikin Ashi, consider these optimization tips:

- Choosing the Right Moving Average: The type and timeframe of the moving average used for smoothing can significantly impact the indicator’s responsiveness. Experiment with different EMAs or other moving averages to find what best suits your trading style and preferred level of smoothing.

- Combining with Other Indicators: As mentioned earlier, the Smoothed Heikin Ashi is most effective when used in conjunction with other technical indicators. Explore combining it with volume indicators, oscillators, or trend-following indicators to gain a more well-rounded perspective of the market.

- Paper Trading: Before deploying the Smoothed Heikin Ashi with real capital, practice using it on a paper trading account. This allows you to test its effectiveness in different market conditions and refine your trading strategy without risking real money.

The Smoothed Heikin Ashi offers a valuable tool for traders seeking to navigate the often-choppy waters of the financial markets. By filtering out short-term noise and providing a clearer view of the trend, it empowers traders to make more informed trading decisions. However, like any indicator, it has limitations. By understanding its strengths and weaknesses, and using it strategically, the Smoothed Heikin Ashi can become a powerful asset in your trading arsenal.

Remember: Always conduct your own research and due diligence before making any trading decisions. The information presented here is for educational purposes only and should not be considered financial advice.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds based on monthly profit share. Let’s do Live Chat with our experts.