In the dynamic world of forex trading, where markets evolve rapidly, traders are constantly seeking advanced tools to gain a competitive edge. Among the multitude of technical indicators available, the Triple Exponential Moving Average, or TEMA, has emerged as a powerful tool for analyzing trends and making informed trading decisions. In this comprehensive guide, we’ll delve into the intricacies of TEMA, exploring its origins, calculation, interpretation, and practical applications in the forex market.

Understanding TEMA

Origins and Development

TEMA was introduced by Patrick Mulloy in the 1994 issue of “Technical Analysis of Stocks & Commodities” magazine. Mulloy designed TEMA to address the lagging issues associated with traditional moving averages by providing a smoother and more responsive indicator. TEMA is a type of exponential moving average (EMA) that incorporates multiple smoothing to reduce noise and enhance trend identification.

The Logic Behind TEMA

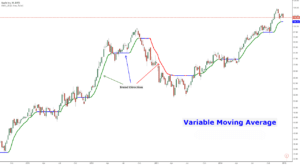

The primary logic behind TEMA lies in its ability to reduce lag and respond more quickly to price changes compared to traditional moving averages. It achieves this by applying three separate EMAs of varying time periods. The triple smoothing process helps filter out short-term price fluctuations and emphasizes the underlying trend, making TEMA a valuable tool for trend-following strategies.

Calculating TEMA

The calculation of TEMA involves three main steps:

- Single EMA Calculation:

- Calculate a single EMA based on the chosen time period.

- Double EMA Calculation:

- Apply the EMA formula again to the result from step 1.

- Triple EMA Calculation (TEMA):

- Repeat the EMA calculation one more time on the result from step 2.

While the formula may seem complex, most trading platforms and charting software provide TEMA as a built-in indicator, sparing traders from manual calculations.

Interpreting TEMA Signals

Trend Identification

One of the primary applications of TEMA is trend identification. Traders use TEMA to distinguish between bullish and bearish trends based on the slope and relative positions of the TEMA lines. An upward-sloping TEMA suggests an uptrend, while a downward slope indicates a downtrend.

Entry and Exit Signals

Entry Signals:

- TEMA Crossovers: Look for the TEMA line crossing above the price for potential long entries, and vice versa for short positions.

- Price Relation: Confirm entry signals with additional price action analysis to ensure alignment with broader market trends.

Exit Signals:

- Changing TEMA Slope: A significant change in the slope of the TEMA lines may signal a potential reversal or the end of a trend, prompting traders to consider exiting or re-evaluating their positions.

- Support and Resistance: Use key support and resistance levels in conjunction with TEMA to identify potential exit points.

Filtering Market Noise

TEMA’s triple smoothing process makes it effective in filtering out market noise and providing a clearer view of the underlying trend. This can help traders avoid false signals and make more informed decisions in volatile market conditions.

Practical Applications in Forex Trading

Trend Confirmation

Traders often use TEMA in conjunction with other technical indicators to confirm the strength and direction of a trend. Combining TEMA with tools like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can enhance the accuracy of trend identification and signal confirmation.

Volatility Adjustments

TEMA’s adaptability to market conditions makes it a valuable tool for adjusting to varying levels of volatility. During periods of heightened volatility, TEMA responds more quickly, providing timely signals. In contrast, during low-volatility periods, TEMA adapts by smoothing out noise and reducing false signals.

Swing Trading and Positional Trading

TEMA’s responsiveness and trend-following characteristics make it suitable for swing trading and positional trading strategies. Traders can use TEMA to identify trends, enter positions on trend confirmations, and ride the trend until signs of a reversal.

Potential Limitations

While TEMA offers distinct advantages, it’s essential to consider potential limitations:

- Whipsaws: Like many trend-following indicators, TEMA is not immune to generating false signals during choppy or sideways markets.

- Optimization Challenges: Determining the optimal parameters for TEMA can be challenging, and traders may need to experiment with different settings to suit specific market conditions.

The Triple Exponential Moving Average (TEMA) stands as a sophisticated and powerful tool in the arsenal of forex traders. Its triple smoothing process, designed to reduce lag and filter market noise, makes it a valuable indicator for trend identification and confirmation. Traders can leverage TEMA in various strategies, from day trading to positional trading, to enhance their decision-making process.

As with any technical indicator, it’s crucial for traders to combine TEMA with other forms of analysis and exercise prudent risk management. Continuous testing and refinement of trading strategies will enable traders to unlock the full potential of TEMA in navigating the complexities of the forex market. By understanding the logic behind TEMA, interpreting its signals effectively, and applying it judiciously in a comprehensive trading strategy, traders can harness the power of this indicator to make more informed and successful trading decisions.

Let’s Manage Your Forex Funds With Fx Pips Guru!

Fx Pips Guru is a forex fund management company managing client’s funds profitably. We work with prop firms as well to pass the challenges and to manage the funds following consistency and profitability. Let’s do Live Chat with our experts.